Business Meals 2024 Tax Deduction – For the tax year 2024, payment processors will report transactions That provision has lapsed. For the 2023 tax year, deductions for business-related meals and beverages from restaurants are back . Tips for servers or bartenders at a business meal tax and tips for the servers. You can only write off 50 percent of the total, and the Internal Revenue Service might not allow the entire .

Business Meals 2024 Tax Deduction

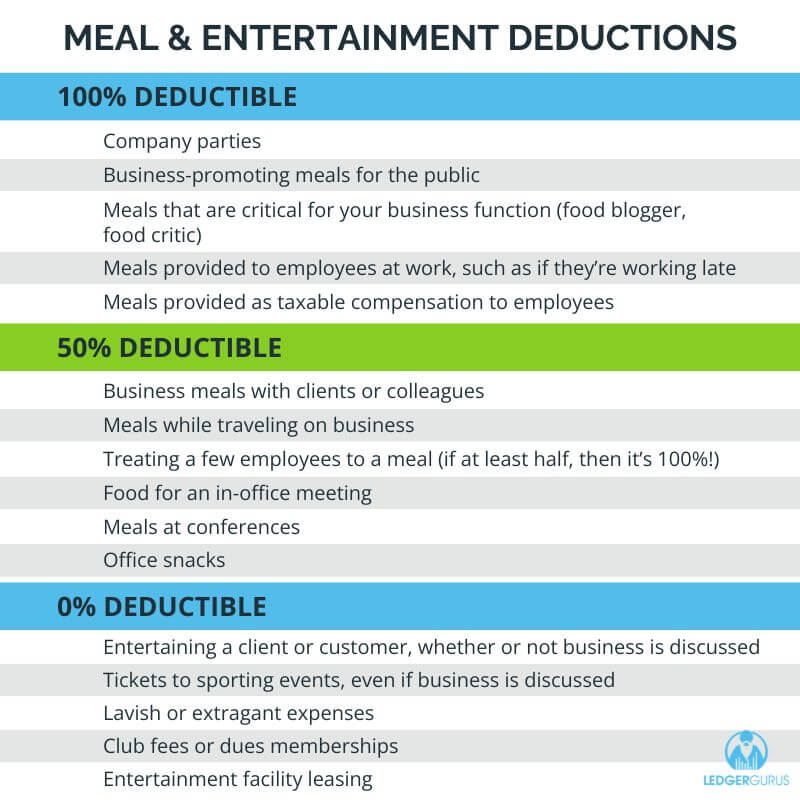

Source : www.freshbooks.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comHow to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.com2024 Tax Breaks: Meals & More Bette Hochberger, CPA, CGMA

Source : bettehochberger.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.comHow to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.comTax Plus | Los Angeles CA

Source : www.facebook.comWhat You Need to Know for the 2024 Tax Season

Source : www.eztaxreturn.comBusiness Meals 2024 Tax Deduction 25 Small Business Tax Deductions To Know in 2024: Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . Meals are tax-deductible when they are business-related, such as when attending a business conference or meeting with a client. However, you can’t deduct expenses for your family member or friend .

]]>

.png)