Business Meals 2024 Deduction – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . Taking advantage of these often overlooked tax deductions can help you lower your tax bill. .

Business Meals 2024 Deduction

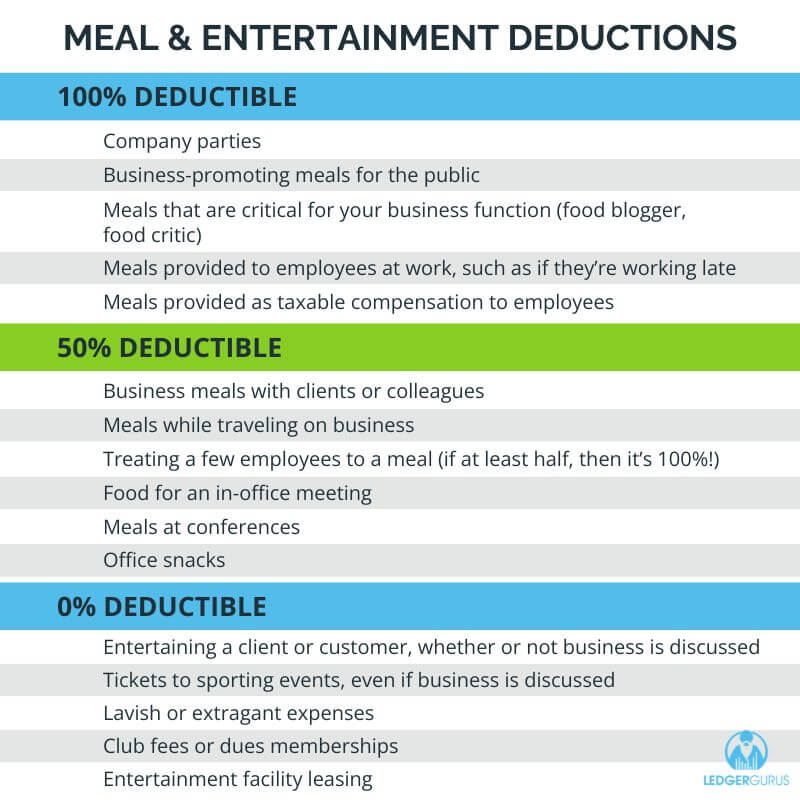

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

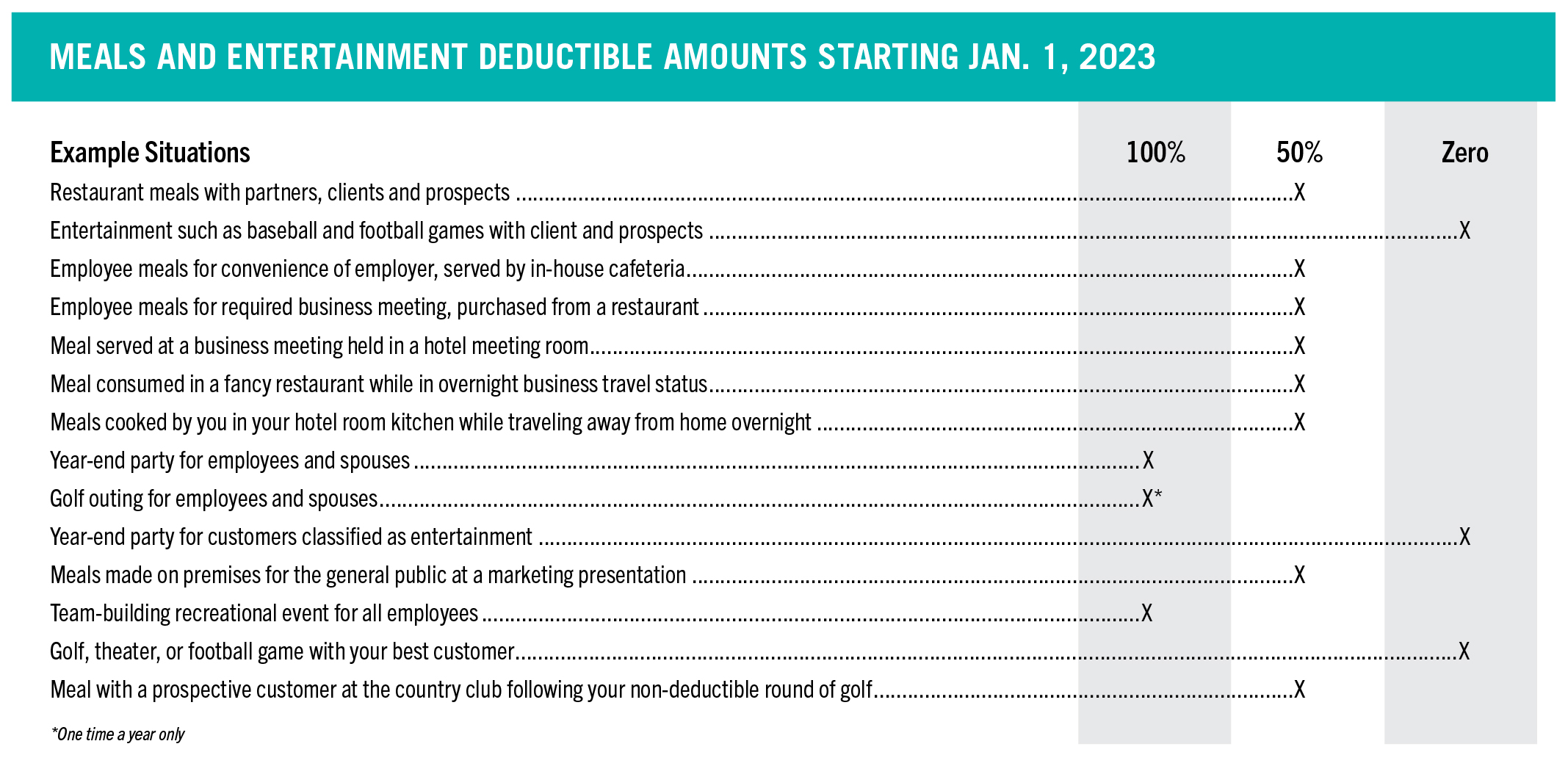

Source : www.ellinandtucker.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coDeducting Meals as a Business Expense

Source : www.thebalancemoney.comHow to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comHow to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comBusiness Meals 2024 Deduction Meal and Entertainment Deductions for 2023 2024: Standard High and Low Rates For business travel, the IRS sets out a standard meal and incidental expense allowance that varies depending on the locality. The rates change every year and are . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

.png)